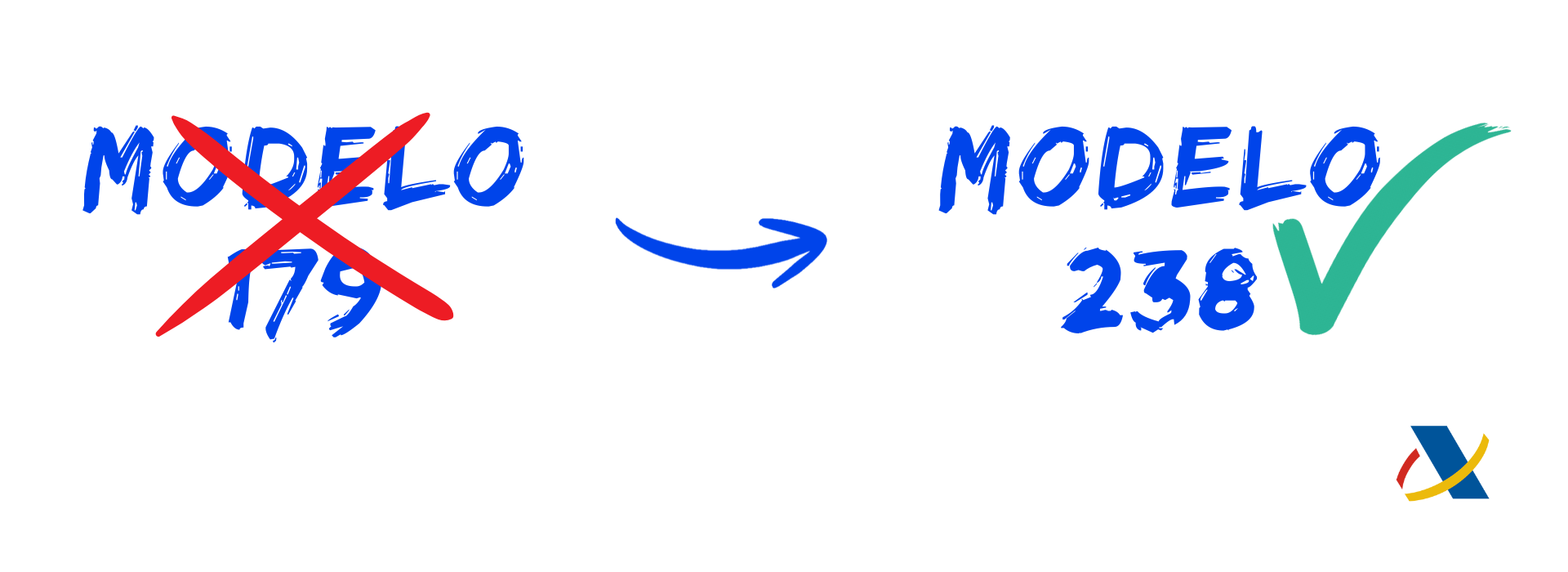

The taxation of vacation rentals continues to evolve, and with it, the reporting obligations related to this activity. In this context, the Spanish Tax Agency has introduced the Model 238, a new reporting form that replaces the former Model 179 and aims to strengthen transparency and oversight of reservations managed through digital platforms.

Although the presentation of the model falls mainly on intermediation platforms, managers and owners must understand what it consists of and how it may affect them in terms of information and data control.

What is Form 238 and what information does it include?

Model 238 is an annual informative declaration that must be filed by digital intermediary platforms managing tourist accommodation bookings. This form replaces the former Model 179 and is aligned with the new European regulatory framework for digital platforms (DAC7).

Through this form, platforms report to the Tax Agency detailed information on vacation rental transactions carried out, including:

- Identification of the host or owner of the accommodation

- Property identification

- Number of days of stay

- Amounts received from rent

- Commissions or other fees charged by the platform

Who is required to submit it?

The obligation to file Model 238 lies with digital intermediary platforms, which are responsible for collecting and submitting reservation data to the Tax Agency within the established deadlines.

Although managers and property owners do not file this form directly, they are indirectly affected, as the Tax Agency may cross-check the data reported by platforms with income declarations. For this reason, it is important that the reported information is consistent with the actual activity and the declared income, in order to avoid potential discrepancies or requests for clarification.

Differences between Form 179 and Form 238

Form 238 replaces Form 179, but maintains its main objective: to improve tax control of holiday rentals.

- Model 238 is adapted to the European digital platforms framework (DAC7).

- It strengthens the standardization of the reported data.

- It consolidates the reporting obligation on platforms, reducing the direct burden on owners and managers.

Understanding how Model 238 works and keeping information well organized is key to managing vacation rentals with greater control and peace of mind.

Contact us now and work with the most complete all-in-one PMS on the market.